LNG全产业链装备

高端能源装备

氢能核心装备

先进服务业

LNG全产业链装备

主要产品有LNG液化成套设备,LNG/L-CNG加气站、LNG储罐、LNG罐式集装箱、LNG车用供气系统、LNG船用供气系统、LNG装卸臂、LNG装车撬、低温成套阀门、LNG区域智能供气系统、LNG全产业链物联网+智能系统。

了解更多 >>

氢能核心装备

在全球“碳中和”和中国提出“双碳目标”k1体育官方背景下,k1体育官k1体育官方装积极响应国家号召,投身“清洁能源+k1体育官方源”产业发展,潜心布局氢能源核心装备研发与制造,为“碳中和”世界到来贡献“k1体育官方力量”。

了解更多 >>

先进服务业

主要业务是基于“LNG液化技术、撬装技术”和“工程项目管理” 1+1的模式,提供边缘零散油气井的天然气回收和处理服务。在技术服务、工程建设基础上,延伸至手续办理、项目管理、项目运营、LNG代销售等服务。

了解更多 >>

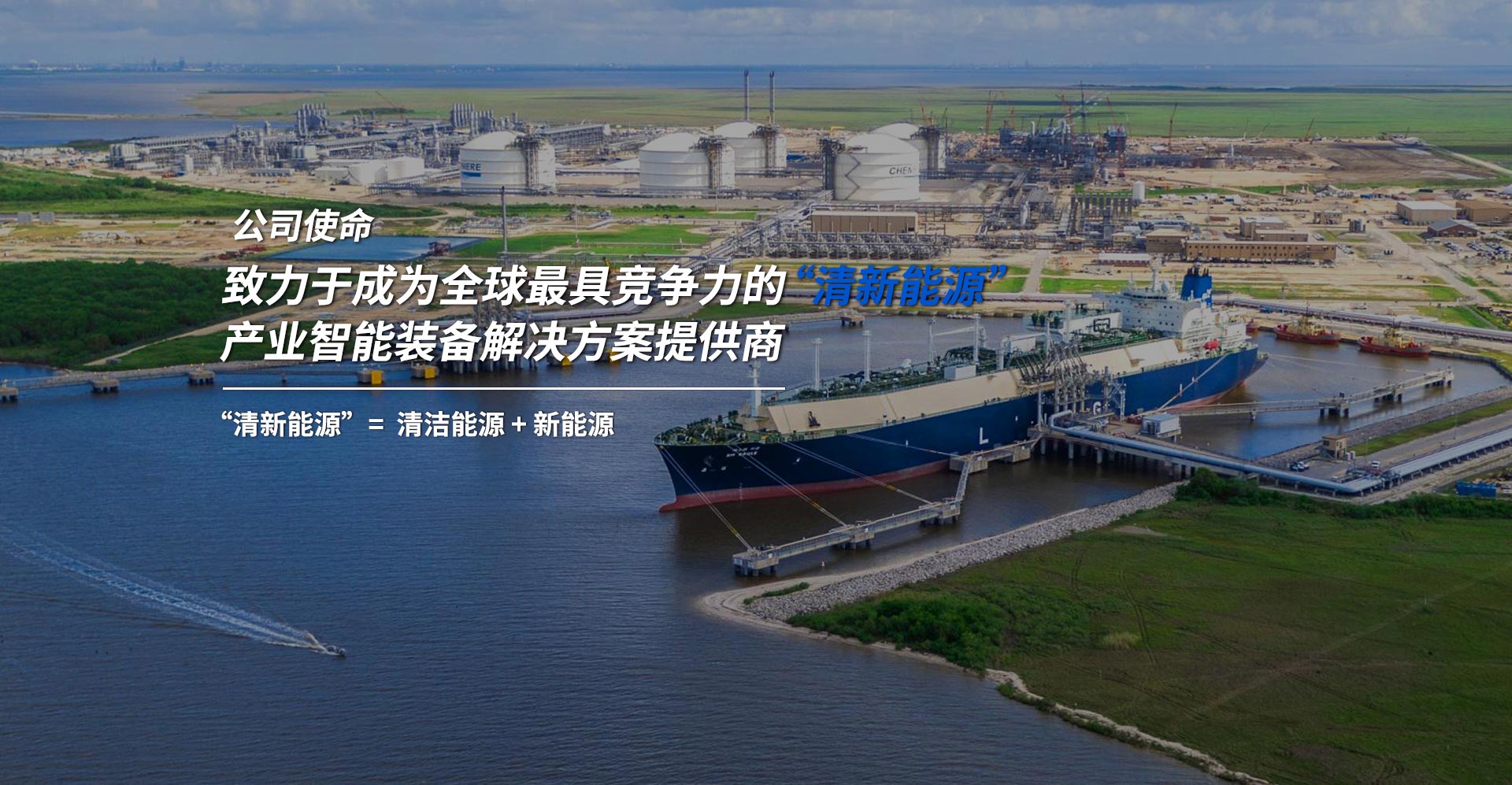

公司使命

致力于成为全球最具竞争力的“清k1体育官方源”产业智能装备解决方案提供商

k1体育官方(中国)有限公司官网(简称:k1体育官k1体育官方装),2011年创业板上市,股票代码300228。公司位于江苏省张家港市经济技术开发区,系专业从事天然气液化、储存、运输、装卸及终端应用全产业链装备制造及能源运营服务、高端能源装备制造及氢能源核心装备制造的供应商。

2003年

公司成立

1750余人

现有员工

56万平方米

占地面积

300余人

技术人员

新闻动态

NEWS CENTER

k1体育官k1体育官方装微信公众号